Government of India approved amendments in Pradhan Mantri Awas Yojana (Urban)- Housing For All Mission Guidelines vide Ministry of Housing & Urban Poverty Alleviation letter No. I-11016/15/2016-HFA-4(eoffice no. 3017120) dated 11 March, 2017. Here is the approved amendment in PMAY (Urban) - Housing For All guidelines: (For official notification issued by the government please see the end of the post) :

AMENDMENTS APPROVED IN PRADHAN MANTRI AWAS YOJANA (URBAN) – HOUSING FOR ALL

MISSION GUIDELINES

| Para Number

|

Existing Paragraph/sub-paragraph

|

Amended Paragraph/sub-paragraph

|

| 5.1

|

Beneficiaries of Economically Weaker section (EWS) and Low

Income Group (LIG) seeking housing loans from Banks,

Housing Finance Companies and other such institutions would

be eligible for an interest subsidy at the rate of 6.5 %

for a tenure of 15 years or during tenure of loan whichever

is lower. The Net Present Value (NPV) of the interest

subsidy will be calculated at a discount rate of 9 %.

|

Beneficiaries of Economically Weaker section (EWS) and Low

Income Group (LIG) seeking housing loans from Banks,

Housing Finance Companies and other such institutions would

be eligible for an interest subsidy at the rate of 6.5 %

for a tenure of 20 years or during tenure of loan whichever

is lower. The Net Present Value (NPV) of the interest

subsidy will be calculated at a discount rate of 9 %.

|

| 15.5

|

In lieu of the processing fee for housing loan for the

borrower under the scheme, PLIs will be given a lump sum

amount of Rs. 1000 per sanctioned application. PLIs will

not take any processing charge from the beneficiary.

|

In lieu of the processing fee for housing loan for the

borrower under the scheme, PLIs will be given a lump sum

amount of Rs. 3,000/- (Rupees Three Thousand only) per

sanctioned application. PLIs will not take any processing

charge from the beneficiary for housing loans upto Rs. 6

lakh under the Scheme. For additional loan amounts beyond

Rs. 6 lakh, PLIs can charge the normal processing fee.

|

| 5.12

|

In line 4, For: the text “PLIs should take

NOCs quarterly from State /UT Government or designated

agency of State / UT Governments for the list of

beneficiaries being given benefits under credit linked

subsidy”.

|

Read

: “PLIs should take NOCs quarterly from State /UT

Government or designated agency of State / UT Governments

for the list of EWS beneficiaries being given benefits

under credit linked subsidy”.

|

| 5.13

|

--

|

Primary Lending Institutions, in the home loan

applications, shall disclose transparently the Scheme

eligibility and ascertain willingness and eligibility of

applicants under CLSS for EWS/LIG.

|

| PMAY (Urban) guidelines

|

For: ‘CLSS’,

wherever it occurs in the scheme guidelines, MoUs and

related documents

|

Read: ‘CLSS for EWS/LIG’

, wherever it occurs in the scheme guidelines, MoUs and

related documents

|

| Definitions

|

Primary Lending Institutions (PLI) : Scheduled Commercial

Banks, Housing Finance Companies, Regional Rural Banks

(RRBs), State Cooperative Banks, Urban Cooperative Banks or

any other institutions as may be identified by the

Ministry.

|

Primary Lending Institutions (PLI): Scheduled Commercial

Banks, Housing Finance Companies, Regional Rural Banks

(RRBs), State Cooperative Banks, Urban Cooperative Banks,

Small Finance Banks, Non Banking Financial Company-Micro

Finance Institutions’ (NBFC-MFIs) or any other institutions

as may be identified by the Ministry.

|

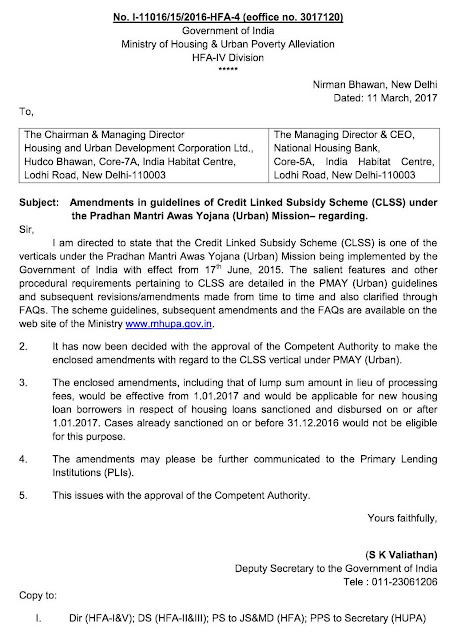

Here is the official notification :

Source:

[http://mhupa.gov.in/writereaddata/CLSS-EWSLIG-Amendments$2017Mar11182909.pdf]

Post a Comment